Our Finance Director Julie shares her top tips on Personal Budgeting!

As part of Multiply, our team will be sharing some top tips around finance, household bills, budgeting and numeracy.. first up is Julie our Finance Director!

Budgets are not just for business! When I talk to business owners one thing we cover is breakeven points. This is the amount of money they absolutely have to bring into the business to cover essential costs. We also talk about how much money they need to take out of the business to cover their home costs.

We have become a society where material possessions and the best of everything are paramount and peer pressure to have the best can make it tempting to overspend unnecessarily. Perhaps going back to a simpler way of living is exactly what society needs.

I do an exercise regularly for myself to check I know how much my bills and spending are so I know how much I absolutely need to cover this and to see if any savings can be made if it’s not looking likely.

Here’s how I do it:

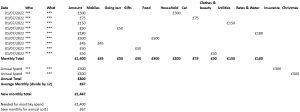

Write down everything, and I mean everything that you spend in the course of a month. I use an excel spreadsheet so I can also categorise each spend item as I go. Once you’ve recorded your monthly spend add in those items that are spent less frequently like subscriptions, insurances and holidays. Don’t forget Christmas and birthdays as these can be quite substantial.

Add up all the columns then convert everything into a monthly amount to see how much you should ideally be bringing home every month. If you are paid weekly you can convert everything to weekly amounts. You don’t have to wait for a new month to start. Most of us use cards to pay for even small items so you can go back through the previous months spending to get the details you need. You might want to analyse your spending over a longer period to make you’ve thought of everything.

If you do not have enough income to cover the expenses it’s now time to look at what expenditure could be reduced. This is where the categories can be helpful as you can see where the bulk of your money goes and which spends are optional.

Sometimes going through your credit card and bank statements can reveal regular payments for things you had forgotten about and which no longer serve you. Make sure you cancel these or give notice to cancel immediately.

Look at the spend on non-essentials and see if this can be cut back, even for a short time to get you back on track. How much are you spending on eating out, nights out, clothes and birthday presents? Work out how much you have left from your income after essentials and putting away for those annual bills and this becomes your monthly budget for non-essentials.

This might be looking a bit scary if there wasn’t much left for non-essentials so now it’s time to look at creative ways of enjoying life and giving to others that cost less. The next blog will feature hints and tips on ways to save money. In the meantime I would highly recommend signing up for the email from Martin Lewis of Money Saving Expert which always has the latest deals and money off coupons available. Money Saving Expert: Credit Cards, Shopping, Bank Charges, Cheap Flights and more

A word of warning though, if you are struggling to make ends meet don’t now be tempted to buy something you don’t absolutely need just because it’s on special offer.

It can be quite time consuming to watch your spending but ideally you should be monitoring your second throughout the month so you’re fully aware of whether you are getting close to your budget limit for that category of spend.

It can also be depressing to feel you can only buy essential items so look for ways to treat yourself that don’t cost anything or very little. Redefine your idea of a treat and train your mind to be grateful for the simple joy of a bubble bath, a walk in the park or a board game with friends.

Here is an extract of a budgeting sheet template

If you need support with understanding your household bills, finances or numeracy check out our multiply programme here

Thanks Julie for your top tips on personal budgeting! Check back again for more top tips from our staff team over the next few weeks!

Post by Julie Bickerdyke

Finance Director

Julie is Director of Finance at Better Connect. She works on strategy to ensure the business is sustainable, using forecasting and scenarios. She monitors the numbers, cash and variances. Her favourite part of her job is teaching new skills, tips and tricks to her team. Julie loves sharing knowledge and developing people.

Julie is secretary of CIMA Members in Practice Panel, providing UK-wide support and access to quality training and development resources. She helped CIMA feed into Treasury how to better help small businesses during the COVID-19 crisis.

Learn more about Julie