‘’Multiply is maths, but in a real way” – Shopping on a Budget With Coterminous CIC

A couple of weeks ago Christine and Laura visited York Travellers Trust, to sit in on the penultimate session of Coterminous’s ‘Shopping on a Budget’ course.

Part of the support on offer through the Multiply programme, Coterminous’s CJ Allison and Harrie Smith (of Transcending Fusion), have been hosting a series of budgeting sessions at the Trust.

The primary aim of the sessions is to equip adults with the necessary skills to manage their own finances. Four sessions into the five-week course, and the group have explored everything from bargains and batch cooking, to socialising on a budget. As CJ explains, it’s all about everyday maths –

‘’Multiply is maths, but in a real way. Socialising and sharing can have a really positive impact.’’

Listening to the group, everyone has arrived at the Trust for different reasons. For one individual who attended the earlier round, it’s a ‘catch up’ and a chance to ‘socialise’, whilst for another, it’s all about practical tools and solutions to prevent the debts from ‘stacking up’ following an unfair dismissal from work. Either way, the group is a great way to round-robin information and resources.

Across the morning, we discussed utilising community cafes and organisations like Planet Food – The Real Junk Food Project and Foxwood’s Community Centre, which operate on a PAYF (Pay As You Feel) basis. For our participants, it’s a way of cutting costs and reducing food waste, all whilst connecting with their local community – especially when living alone and cooking for one can feel like an arduous task.

The group weighed in on supermarkets too – where and when can you find the best prices? Sainsbury’s is staunchly defended; evenings are still best for discounts (6-8pm seems like the sweet-spot), and reward cards can be beneficial, provided you use the deals before they expire. Free trials can also be useful – but be sure to block out a cancellation reminder in your calendar before you find yourself lulled into yet another direct debit.

For one participant, attending the group has encouraged her to adopt a more mindful approach to spending money. She shops around, avoids brands where she can, and has switched from daily to a weekly shop:

‘’I came to the last course too and used to spend money quite freely; I’m now looking for bargains rather than shopping day to day.’’

In all, the sessions are about finding the little wins, developing a greater sense of confidence with numbers, and finding ways to make your finances go that bit further. The social element of the group is also key, allowing participants the chance to chat, express concerns, share resources, and improve their wellbeing.

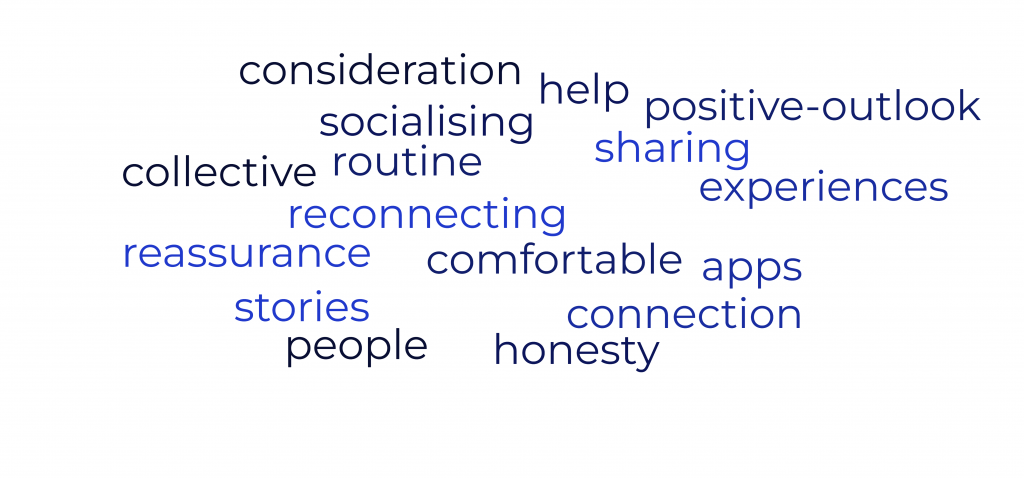

Concluding the session, CJ and Harrie open up the floor, asking the group to sum up their experience of the day’s session in a word. Everyone’s answer is different, but the overarching theme is connection – a hugely positive takeaway when financial fear can leave you feeling isolated and hesitant to share:

Thank you to CJ, Harrie & the group for allowing us to sit in on your session!

- For more on Coterminous, you can visit their website here: Projects | Coterminous CIC

- For other PAYF, community fridges and food banks, check out York Food Justice Alliances’ Community Food Map.

Post by Laura Sandiford

Impact Manager

A keen storyteller & collaborator, Laura works as the Impact Manager together with our Head of Impact, Hannah, where she measures and highlights the impact of Better Connect across the business, programmes and partnerships.

She does so by working with a range of partners, participants and externals to gather information and stories, which she then translates into a range of engaging content across Better Connect’s channels. Ensuring the ‘Better Connect’ story is woven throughout all communications is a large part of Laura’s role, as is demonstrating the ripple effect across our programmes, partnerships, and sector-advocacy.

Laura’s favourite part of the role is connecting with the faces behind the case studies and giving voice to their experiences.

Learn more about Laura