“It’s easy to get into debt – but hard to get out” – Multiply Participant Stories

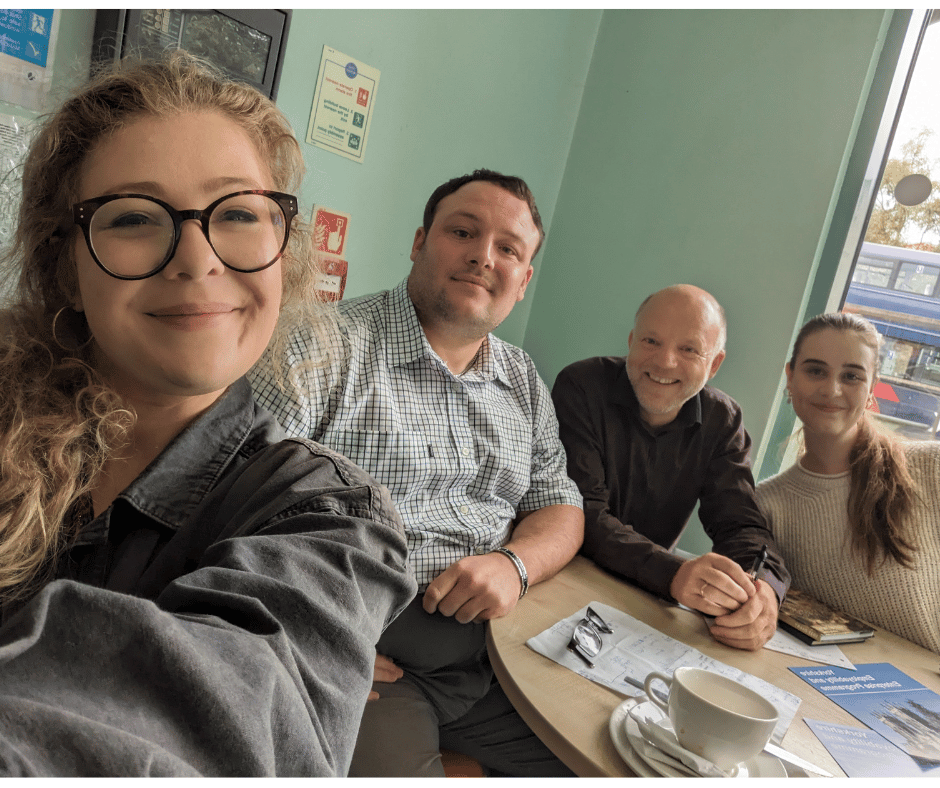

A few weeks back, we had the pleasure of visiting Multiply keyworker CJ Allison and his participants Dan and David as they battled through some budgets, talked financial self-advocacy, and discussed self-employment tips and tricks. Multiply is the government’s new multi-million-pound programme to help transform the lives of hundreds of thousands of adults across the UK. Better Connect have formed a partnership with local organisations, like Coterminous, to help individuals develop their skills in numeracy. We are also working with employers to highlight the benefit of developing numeracy skills within the workplace, outside of needing a formal GCSE qualification in maths.

Beyond the classroom, numeracy has so many practical applications in day-to-day life. You might not use an algebraic formula every day, but you most likely have experience of budgeting and navigating numbers, whether that’s through bills, your weekly shop, helping your kids with the homework, or a tax return.

This is where Multiply and CJ come in – interested to see how numeracy fits into our participants’ lives?

DAN

For Dan, Multiply sessions have focused on getting familiar with tracking spend and budgeting across the month. He lives with his elderly grandmother, and last year through the help of Community Grants (a former project of ours) found employment in the NHS as a Catering Operative.

Although Dan admits that he is pretty good with his finances and aware of the implications of overspending- ‘’ ’it’s easy to get into debt- hard to get out’’, he’s keen to plan for his future and acknowledges he might not be able to remain living with his nan indefinitely- something he’s discussed with CJ.

Whilst Dan’s grandmother has previously emphasised the importance of having both longer and shorter-term savings, Multiply has supplied an accessible ‘’structure and focus’’ for looking at his finances and assessing which expenses are non-negotiables, (rent, Netflix & Disney Plus, fish food for his new Axolotl). Part of the sessions have included creating spreadsheets for Dan to track and categorise spend, so he is better equipped to see areas of overspend, and able to adjust his budget accordingly.

So far, the focus has been about familiarising Dan with his habits and working alongside his lifestyle to optimise his income. We talked online banking, exercising caution when sharing banking information, and financial boundaries- specifically about how you can show generosity to friends and family in a non-monetary way.

Multiply is equipping Dan with the skills to approach his finances a little differently. He’s generally more conscious of his money, able to do ‘’sums’’ in his head with ease, and the project has reiterated the importance of saving, implementing boundaries, and planning for the future- all invaluable life skills.

DAVID

Like Dan, David first received support on Community Grants after he was introduced to CJ by his Work Coach. Despite formerly finding work as a chauffeur, Mechanic, and even as Landlord to a pub amongst other things, David has struggled to find his place within the (modern) labour market, finding that without formal qualifications (like GCSE Maths) he is considered less employable.

A year since the support from CG ended, we attended David’s sign-up session for Multiply. The two had previously talked at length about how the programme could help in earlier meet ups, and although initially it was hazy how Multiply would fit into David’s life, it was when the two got chatting about self-employment and CJ asked ‘’what are you like with books?’’ that it became clearer how the project could support. Like Dan, David is not bad with money or numeracy, in fact he actively described having a ‘’positive relationship with Maths at school’’. Instead, part of the issue for David is managing money within a family dynamic and working on asserting healthy personal, and financial boundaries.

Several weeks into CJ and David re-connecting, David found employment with an elderly lady (driving and doing jobs within the house), and CJ has been supporting him to set up as self-employed and negotiate professional boundaries within his newfound employment. For David, the support has been holistic, about weaving numerical relevance into his everyday life. Discussions have centred on insurance, taxes, invoicing, budgeting, realistic savings, but also family life and teething issues within his new role.

Numeracy aside, Multiply sessions are helping David in an unexpected way. Having struggled for years with his mental health, getting involved in the project is simultaneously helping David to ‘’get back into the community and engage’’ but also, importantly, learn to speak the language of self-employment and self-advocacy.

Multiply is not just Maths, it’s about supporting and empowering individuals within their lives and work. Click here to find out more, and contact Christine Brass Multiply Programme Manager to learn how we can help: – cbrass@betterconnect.org.uk

Post by Laura Sandiford

Impact Manager

A keen storyteller & collaborator, Laura works as the Impact Manager together with our Head of Impact, Hannah, where she measures and highlights the impact of Better Connect across the business, programmes and partnerships.

She does so by working with a range of partners, participants and externals to gather information and stories, which she then translates into a range of engaging content across Better Connect’s channels. Ensuring the ‘Better Connect’ story is woven throughout all communications is a large part of Laura’s role, as is demonstrating the ripple effect across our programmes, partnerships, and sector-advocacy.

Laura’s favourite part of the role is connecting with the faces behind the case studies and giving voice to their experiences.

Learn more about Laura